Research and Talks

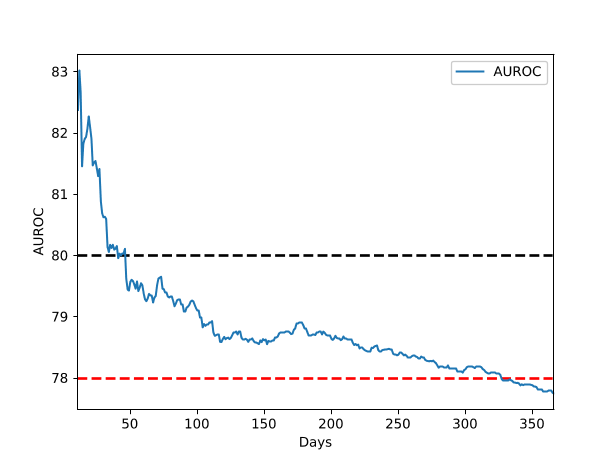

Depression Onset Prediction on a Large Medical Claims Data Using Deep Learning

Globally 264 million people suffer from depression. Depression and anxiety cost $1 trillion each year in lost productivity. Here we are proposing the prediction of onset of depression using commercial medical claims data. We are using 2297 medical indicators for the 2 years of observation window and predicting depression risk probability for one year of prediction window. We developed a CNN + BiLSTM + Attention neural network architecture and trained it on 7.2 million patients’ claims. This and another previous study suggests that medical claims data holds information to predict depression. Using the medical claims dataset predicts depression is an inexpensive method and a good representative of the population due to its ease of gathering and ubiquity. Access the talk here.

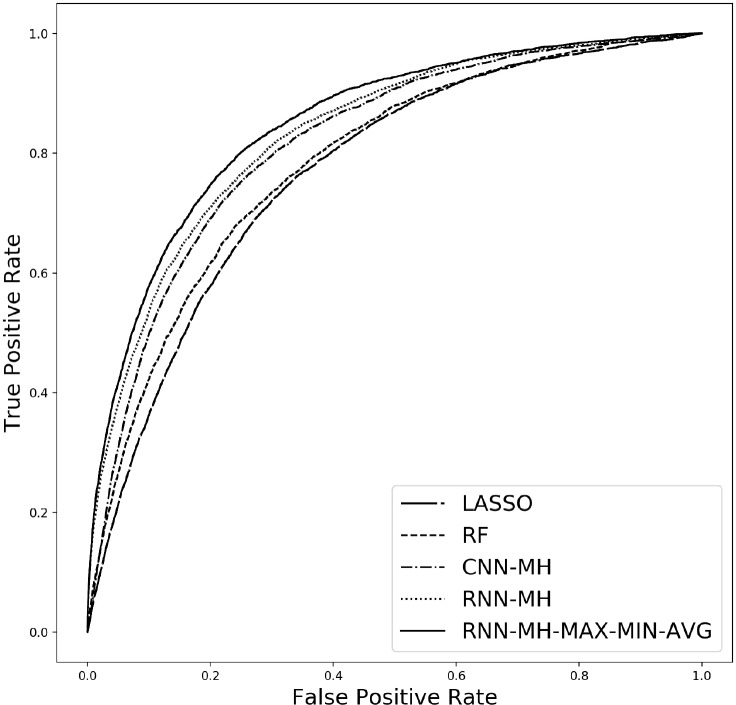

Total Joint Replacement Risk Prediction: A Deep Learning Based Approach With Claims Data

Total joint replacement (TJR) is one of the most commonly performed, fast-growing elective surgical procedures in the United States. Given its huge volume and cost variation, it has been regarded as one of the top opportunities to reduce health care cost by the industry. Identifying patients with a high chance of undergoing TJR surgery and engaging them for shopping is the key to success for plan sponsors. In this paper, we experimented with different machine learning algorithms and developed. Access it here.

Record statistics of financial time series and geometric random walks

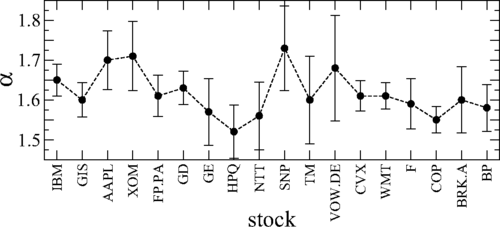

The study of record statistics of correlated series is gaining momentum. In this work, we study the records statistics of the time series of select stock market data and the geometric random walk, primarily through simulations. We show that the distribution of the age of records is a power law with the exponent α lying in the range 1.5≤α≤1.8. Further, the longest record ages follow the Fréchet distribution of extreme value theory. The records statistics of geometric random walk series is in good agreement with that from the empirical stock data.

Access it here.